suntorin.ru Gainers & Losers

Gainers & Losers

How To Get An Ebt Card In Florida

If you need assistance to re-apply for SNAP benefits over the telephone, you can call the Florida Department of Elder Affairs statewide, toll-free Elder. SNAP. Capital Access Card. Florida. FL. Food Assistance Program. State of Florida. Georgia. GA. Food Stamp Program. Georgia EBT. Guam. GU. SNAP. Guam Quest. Clients can apply online for free by using the Office of Economic Self Sufficiency Self Service Portal or by visiting a DCF Community Partner. Apply SNAP benefits · Step 1: Add EBT card. Sign in to add to your Wallet & check card balance. Get started · Step 2: Shop items. Get pickup or delivery from your. The Department of Children and Families (DCF) is issuing emergency SNAP (food assistance or food stamp) supplements to many SNAP households to help buy food. You can apply for Florida ACCESS EBT card by simply visiting this link. You can also find a pre-screening tool on the My Florida website. This article will guide you through understanding Food Stamp benefits in Florida, including eligibility criteria and the application process step-by-step. Annual Income: Applicants are eligible for SNAP by ESS if they meet the federal guidelines. · Citizenship: You must reside in Florida as a citizen or legal. Applying for Benefits. You may apply for help by giving us just your name, address, and signing your application. We encourage you to answer as many. If you need assistance to re-apply for SNAP benefits over the telephone, you can call the Florida Department of Elder Affairs statewide, toll-free Elder. SNAP. Capital Access Card. Florida. FL. Food Assistance Program. State of Florida. Georgia. GA. Food Stamp Program. Georgia EBT. Guam. GU. SNAP. Guam Quest. Clients can apply online for free by using the Office of Economic Self Sufficiency Self Service Portal or by visiting a DCF Community Partner. Apply SNAP benefits · Step 1: Add EBT card. Sign in to add to your Wallet & check card balance. Get started · Step 2: Shop items. Get pickup or delivery from your. The Department of Children and Families (DCF) is issuing emergency SNAP (food assistance or food stamp) supplements to many SNAP households to help buy food. You can apply for Florida ACCESS EBT card by simply visiting this link. You can also find a pre-screening tool on the My Florida website. This article will guide you through understanding Food Stamp benefits in Florida, including eligibility criteria and the application process step-by-step. Annual Income: Applicants are eligible for SNAP by ESS if they meet the federal guidelines. · Citizenship: You must reside in Florida as a citizen or legal. Applying for Benefits. You may apply for help by giving us just your name, address, and signing your application. We encourage you to answer as many.

If you are not receiving SNAP, TANF, or Medicaid, but you have a child who is eligible for the free and reduced-price school meal program, the P-EBT benefit. Florida WIC EBT. WIC EBT Customer Service. 24 Hours a How will I get benefits with my WIC EBT Card? Your food benefit amount will. If you qualify, you will get your Electronic Benefits Transfer (EBT) card. Florida benefits and works like a debit card at most grocery stores. You can. Fraud alert. EBT fraud is on the rise! Fraudsters will try anything to obtain your EBT card number and PIN. Never share your PIN with anyone. Do. EBT Assistance · Check My EBT Account Online · EBT Customer Number: · More Program Information. Call the Florida Department of Children and Families (DCF) at (TTY ) if you have questions about renewing your coverage or if you missed your. Benefits are paid by electronic benefit transfer (EBT) cards rather than You provide proof of identity, live in Florida and are a US citizen or have qualified. FAB doubles your purchase! Want to spend $10 on your SNAP/EBT card? You get an extra $10 for free fresh, Florida produce! No advance sign up necessary. The Florida Supplemental Nutrition Assistance Program gives you a special debit card with money on it to help you buy food. To apply for the Florida SNAP and. SNAP is accepted at Florida State University Tallahassee's campus at the POD Market in the Honors, Scholars, and Fellows house(HSF). What can SNAP benefits buy? How long does it take to get ur ebt card in the mail? (FL) 7 to 10 working days usually. If your approval notice has a date sent on it then. It is NOT possible to apply for the EBT card or carry out related procedures through this application. The main purpose of this description is to provide clear. SNAP Calculator: Do you qualify for SNAP in Florida Transfer (EBT) card instead of going into stores. At present, participating. The Florida EBT card is a reloadable card that is mailed out to SNAP recipients once they are approved for the program. The EBT card can be used at locations. Call the EBT customer service department at You will be prompted to enter your card number; if you do not have it, your Social Security number. Florida residents can apply for SNAP through Access Florida, the ESS self-service portal found here. You can also fill out a paper application that can be. This electronic debit (EBT) card will be mailed to the address you provided on your SNAP application. Florida's SNAP website. SNAP agents are available. The fastest way to apply for programs, including TCA, SNAP, or Medicaid is online. If you have problems, you can get help from a Community Partner. Florida WIC clients use a WIC EBT card to purchase WIC-approved foods at authorized WIC grocery stores. If you have a WIC EBT card and have questions or. Florida Department of Children & Families, ACCESS • Customers can order an EBT card, get information about EBT transactions, or report an EBT card as.

Financing A Second Home For Rental

Whether you're looking for an investment property or a vacation home, financing a second home can be a lucrative investment if you're financially prepared. A second home is a home you intend to live in during part of the year. An investment property is one you intend to rent out rather than live in. Interest rates for second homes are slightly higher than primary home mortgages, and you may need more than the standard 20% down payment. To buy a second home and rent the first, you need to either qualify for a second mortgage or buy the second home with cash. The more money you have, the easier. A first solution to finance the down payment on your second home would be to use your personal savings. So if you're thinking of buying a second home, start. House hacking is a more accessible way to buy a rental property, because you can use a government-backed loan that only requires a 0% to % down payment. You. Conventional loans for a second home require a 10% minimum down payment for a second home, while jumbo loans require a minimum of 20% or more. Can I buy a second home if I don't own a primary residence? Yes. Many people in expensive cities choose to rent their primary residence and purchase a secondary. 5 steps to buy a second home and rent the first · 1. Assess your financial situation · 2. Find money for another down payment · 3. Ensure the first home will. Whether you're looking for an investment property or a vacation home, financing a second home can be a lucrative investment if you're financially prepared. A second home is a home you intend to live in during part of the year. An investment property is one you intend to rent out rather than live in. Interest rates for second homes are slightly higher than primary home mortgages, and you may need more than the standard 20% down payment. To buy a second home and rent the first, you need to either qualify for a second mortgage or buy the second home with cash. The more money you have, the easier. A first solution to finance the down payment on your second home would be to use your personal savings. So if you're thinking of buying a second home, start. House hacking is a more accessible way to buy a rental property, because you can use a government-backed loan that only requires a 0% to % down payment. You. Conventional loans for a second home require a 10% minimum down payment for a second home, while jumbo loans require a minimum of 20% or more. Can I buy a second home if I don't own a primary residence? Yes. Many people in expensive cities choose to rent their primary residence and purchase a secondary. 5 steps to buy a second home and rent the first · 1. Assess your financial situation · 2. Find money for another down payment · 3. Ensure the first home will.

If you are buying a second home as an investment or rental property, it is a good idea to look at the potential income you might earn from these properties as. Having a second home is becoming more and more of a necessity than a luxury. It is an idea well worth your consideration because the second home will not just. Eligibility requirements · The Mortgage must be secured by a 1-unit property · The Borrower must occupy the second home for some portion of the year · The Borrower. This is not a program for purchasing rental properties. If you're looking to purchase an investment property, a mortgage broker can help with that too but it's. 5 steps to buy a second home and rent the first · 1. Assess your financial situation · 2. Find money for another down payment · 3. Ensure the first home will. Whether it's a vacation home, rental property or cottage, using your home's equity can be a great way to finance the purchase of a secondary property you've. To Rent Out Your Home And Get a Second Mortgage To Buy a New House You usually need to qualify to carry both mortgages. Just as when you applied for your. Second home loan rates are more like those of primary residences, while an investment property will typically have much higher interest rates. Buying a second home is a huge financial decision regardless of whether you're using it as a vacation home or a rental property. In many cases, Foundation Mortgage will accept loan applications as a second home with some seasonal rental income! Most lenders will not offer you a second-home mortgage if you plan to rent the home out for any time period. For example, you can qualify for a second-home. Apart from property taxes, any rental income could potentially push you into a higher tax bracket. Also, if you use a second home as both a rental property and. The difference here is that you would use an equity loan rather than a first mortgage. This option can work well when using the funds as a reserve account for. A conventional loan will allow you to rent the second home for up to six months per year without it being qualified as an investment property – as long as you. If you want to buy a second home to use primarily as a rental property, lenders and the IRS will classify it as an investment property. Owning a rental property. Mortgages on second homes are a full two points better than an investment property. The rules say that in order for a home to qualify as a. Also, lenders might worry that you're more likely to skip payments on an investment property if you get into financial trouble. The lender may ask for a rent. If the second property's primary purpose is to serve as an investment property, lenders will consider the potential rental income; however, they will also. Get approved to buy a second home. Apply online with Rocket Mortgage®. Start My Approval. The Bottom Line: Real Estate Investors Need Lenders Who Understand. According to the mortgage giant Fannie Mae, rental income cannot be taken into consideration to qualify for a mortgage on a second home, but they are fine if.

Best Place To Learn Swift

Learning Swift could be an excellent starting point for those who want to build a career in software development. Apple created the Swift programming language. Some of the best Swift courses are offered by Coursera, Udemy and Alison. You can go for the best Swift courses from these MOOC platforms based on. Explore top courses and programs in Swift. Enhance your skills with expert-led lessons from industry leaders. Start your learning journey today! SWIFT DESIGN PATTERNS Learn smart, idiomatic techniques to design great Swift learn to build awesome web apps, APIs, and websites all using Swift. Learn Swift From Basics In This Free Online Training. Swift Tutorial Is Taught Hands-On By Experts. Best For Beginners. Enroll In Swift Free Course & Get. 1. Design+Code. Design+Code is a website where you'll learn SwiftUI from scratch. · 2. SwiftUI — The Complete Course — Building Real World Apps · 4. Apple. The Swift Programming Language book gives a complete overview of the Swift programming language, and is the perfect place to begin your journey learning Swift. Build your swift skills on the go with this amazing free app to learn Swift Programming. Become a Swift programming expert by learning the swift coding. The best place to start learning swift is official apple book on swift. Actually there's two of them. As you read past at least half of the book. Learning Swift could be an excellent starting point for those who want to build a career in software development. Apple created the Swift programming language. Some of the best Swift courses are offered by Coursera, Udemy and Alison. You can go for the best Swift courses from these MOOC platforms based on. Explore top courses and programs in Swift. Enhance your skills with expert-led lessons from industry leaders. Start your learning journey today! SWIFT DESIGN PATTERNS Learn smart, idiomatic techniques to design great Swift learn to build awesome web apps, APIs, and websites all using Swift. Learn Swift From Basics In This Free Online Training. Swift Tutorial Is Taught Hands-On By Experts. Best For Beginners. Enroll In Swift Free Course & Get. 1. Design+Code. Design+Code is a website where you'll learn SwiftUI from scratch. · 2. SwiftUI — The Complete Course — Building Real World Apps · 4. Apple. The Swift Programming Language book gives a complete overview of the Swift programming language, and is the perfect place to begin your journey learning Swift. Build your swift skills on the go with this amazing free app to learn Swift Programming. Become a Swift programming expert by learning the swift coding. The best place to start learning swift is official apple book on swift. Actually there's two of them. As you read past at least half of the book.

If you're looking for a beginner-friendly OS-based programming language, Swift is a great place to start. Its simple syntax reads much like high-level. Best Swift Certifications and Courses ; Course, SwiftUI Masterclass - iOS App Development & Swift, NA ; Course, Swift 5 Essential Training Online Class, NA. tutorials point logo. Tutorials Point is a leading Ed Tech company striving to provide the best learning material on technical and non-technical subjects. Want to learn Swift? This is the best place to start. Read as much as you can. Ask questions. Contact one of our RMIT Online course counsellors. You can find. The Stanford course on iTunes U is probably the best resource to start Swift development. And it's free! Then it's pretty much a matter of. "When I need courses on topics that my university doesn't offer, Coursera is one of the best places to go. It provides a good structure for learning Swift. Learning Swift: Building Apps for macOS, iOS, and Beyond [Manning, Jonathon, Buttfield-Addison, Paris, Nugent, Tim] on suntorin.ru You can learn to code with Apple's Swift Playgrounds Learn to Code interactive tutorials, which will teach you the basics of Swift programming. My 8-year-old. Swift relates to DevelopmentIT & Software · Free learning on Udemy · Free Swift lessons · Get more with paid Swift courses · Try free courses or enroll in paid. 5 Best Free Swift Online Courses for iOS developers in · 1. Introduction to iOS 11 Development: Swift and Xcode [Free] · 2. Learn Swift Programming for. Swift is a powerful programming language that is easy and also fun to learn. Its code is safe by design, yet also produces software that runs lightning-fast. Noob to App Store - iPhone Apps with Swift, SwiftUI & iOS 15 · iOS Masterclass: Build An iOS AppStore-Quality App In Swift · SwiftUI - Learn How to Build. Free Swift and iOS tutorials · Not sure where to start? We recommend you try the Days of SwiftUI. Days of Swift · Proven solutions. Search over 5 Best Apps To Learn Swift 1. Swifty 2. Swifti 3. Code! 4. Learn programming with swift 5. SwiftBites. Appreciate. Made with Adobe Slate. Developer resume generator · suntorin.ru Swift and iOS 12 Bootcamp · suntorin.ru The iOS Programming Course · suntorin.ru iOS and OS X Development · 6. Swift is a powerful and intuitive programming language for iOS, iPadOS, macOS, tvOS, and watchOS. Writing Swift code is interactive and fun. Learn Swift, earn certificates with paid and free online courses from Stanford, UC Irvine, University of Toronto, Moscow Institute of Physics and Technology. Andrew, BloomTech's iOS Swift Bootcamp lead says, “I think Swift is a great first programming language to learn, and that's not a coincidence. When Apple was. Kudos to you for wanting to learn Swift Writing your own programs or Apps while you learn parts of a language help some people remember concepts better. Yes, anyone can learn Swift. On-site, hybrid, and online Swift training programs offer an educational platform for learners of all levels to develop proficient.

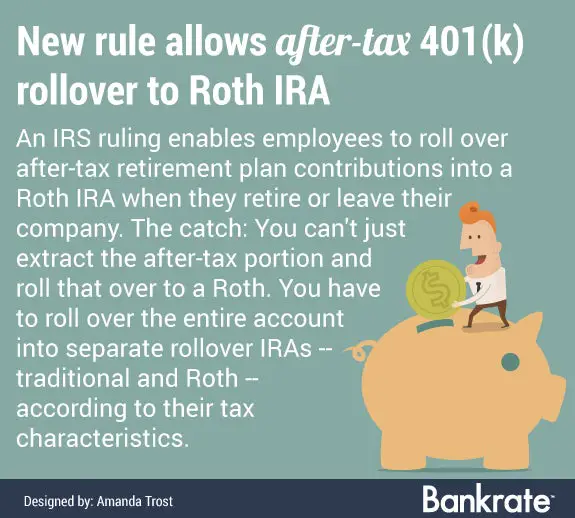

Do You Pay Taxes On 401k Rollover To Roth Ira

One of the key benefits of a Roth IRA or Roth (k) is that, while contributions aren't tax-deductible, both contributions and earnings can be. With a rollover, you are not withdrawing any money or taking distributions, so you will not have to pay any taxes or penalties as a result. (k) rollover. This rollover transaction isn't taxable, unless the rollover is to a Roth IRA or a designated Roth account from another type of plan or account, but it is. IRA, conversion is gener- ally taxable for federal income tax purposes. Maximum. Tax Year: Under Age Same. If you have both. Contribution an IRA and. When converting your before-tax savings, you're including the converted amount as ordinary income, but without an IRS 10% additional tax for early or pre 1/2. Pre-tax only: You can only transfer pre-tax IRA funds to a (k). Under current law, you cannot transfer Roth IRA assets into a Roth (k) or Roth b. The. Any Traditional (k) assets that are rolled into a Roth IRA are subject to taxes at the time of conversion. You may pay annual fees or other fees for. Then you can convert the trad IRA balance to a Roth IRA. The amount converted will be taxable as regular income, so if it's too much to do all. A direct rollover from a Roth (after-tax) (k) plan into a Roth IRA is generally not a taxable event. However, if you have any pre-tax money. One of the key benefits of a Roth IRA or Roth (k) is that, while contributions aren't tax-deductible, both contributions and earnings can be. With a rollover, you are not withdrawing any money or taking distributions, so you will not have to pay any taxes or penalties as a result. (k) rollover. This rollover transaction isn't taxable, unless the rollover is to a Roth IRA or a designated Roth account from another type of plan or account, but it is. IRA, conversion is gener- ally taxable for federal income tax purposes. Maximum. Tax Year: Under Age Same. If you have both. Contribution an IRA and. When converting your before-tax savings, you're including the converted amount as ordinary income, but without an IRS 10% additional tax for early or pre 1/2. Pre-tax only: You can only transfer pre-tax IRA funds to a (k). Under current law, you cannot transfer Roth IRA assets into a Roth (k) or Roth b. The. Any Traditional (k) assets that are rolled into a Roth IRA are subject to taxes at the time of conversion. You may pay annual fees or other fees for. Then you can convert the trad IRA balance to a Roth IRA. The amount converted will be taxable as regular income, so if it's too much to do all. A direct rollover from a Roth (after-tax) (k) plan into a Roth IRA is generally not a taxable event. However, if you have any pre-tax money.

The conversion amount would be reported as taxable income. You should consider federal, state, and local income taxes that would apply. · The conversion amount. Now you can direct pre-tax dollars to one account and after-tax dollars to another to avoid tax liability. Previous law treated a direct rollover from an. tax treatment than it would be if you received a taxable distribution from OPM. You must pay tax on the taxable portion rolled into a Roth IRA in the year. 7 Contingent on specific plan rules. 8 Distributions from a Roth IRA are not subject to federal income tax, provided you have satisfied a five-year holding. When you roll over a retirement plan distribution, you generally don't pay tax on it until you withdraw it from the new plan. By rolling over, you're saving for. For more information see IRS Publication ,. Pension and Annuity Income. If you roll over your payment to a Roth IRA you choose to do a rollover to an IRA. When you roll over a (a) into an IRA, you don't pay any tax but in some cases there may be fees involved. Typically, there aren't any associated fees, but. If you convert traditional (k) or IRA assets to a Roth, you'll owe taxes on the converted amount. But you won't owe any taxes on qualified withdrawals in. The Roth IRA is set up so that your contributions are taxed, and you do not need to pay any taxes when you begin withdrawing money once you reach retirement age. You must pay ordinary income tax on the amount converted (specifically, on pre-tax contributions and investment gains). If you pay the taxes using money from. If you meet the specific requirements of a backdoor Roth strategy, the conversion is not taxable. Keep in mind, however, a backdoor Roth conversion is an. If you do this, you might get most of the withheld amount back in a refund when you file your taxes since it won't be needed to pay the tax on the withdrawal. Then you can convert the trad IRA balance to a Roth IRA. The amount converted will be taxable as regular income, so if it's too much to do all. For instance, if you expect your income level to be lower in a particular year but increase again in later years, you can initiate a Roth conversion to. If you're moving your retirement savings funds to a new plan through a direct rollover to a traditional IRA or a different (k), no tax withholding is. For instance, if you expect your income level to be lower in a particular year but increase again in later years, you can initiate a Roth conversion to. If this rollover establishes your first Roth IRA, that would mean that it will be longer before a distribution of earnigns would be tax free than if the funds. See the section below titled "If You Roll Over Your Payment To a Roth IRA" for more details. income tax) that you do not roll over, unless one of the. The good news for high income taxpayers is that they can still benefit from the Roth tax treatment if they're willing to convert either traditional IRA or (k). "Converting from a Traditional IRA to a Roth IRA does not incur age-related penalties, regardless of your age. The critical considerations for a.

Income Stock

Vanguard Target Retirement Income Fund (VTINX) - Find objective, share price, performance, expense ratio, holding, and risk details. O | Complete Realty Income Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Risk of this Type of Fund · Objective. Seeks a high total return through a combination of current income and capital appreciation. · Strategy. Normally investing. The Real Estate Income Fund invests primarily in income-producing common stocks, preferreds, convertible preferreds and debt issued by real estate. Analyze the Fund Fidelity ® Capital & Income Fund having Symbol FAGIX for type mutual-funds and perform research on other mutual funds. Learn more about. To understand these differences and decide which fund is best suited for you, review the prospectuses and consult your investment professional. JPIE. JPMorgan. The Income Fund of America (Class A | Fund 6 | AMECX) seeks to provide current income while secondarily striving for capital growth. This Fund offers investors an actively managed core U.S. fixed income fund that invests in a diversified portfolio of primarily high-quality bonds and other. Income stocks are equity financial securities that pay regular and predictable dividends. They are purchased to generate a steady stream of dividend flows. Vanguard Target Retirement Income Fund (VTINX) - Find objective, share price, performance, expense ratio, holding, and risk details. O | Complete Realty Income Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Risk of this Type of Fund · Objective. Seeks a high total return through a combination of current income and capital appreciation. · Strategy. Normally investing. The Real Estate Income Fund invests primarily in income-producing common stocks, preferreds, convertible preferreds and debt issued by real estate. Analyze the Fund Fidelity ® Capital & Income Fund having Symbol FAGIX for type mutual-funds and perform research on other mutual funds. Learn more about. To understand these differences and decide which fund is best suited for you, review the prospectuses and consult your investment professional. JPIE. JPMorgan. The Income Fund of America (Class A | Fund 6 | AMECX) seeks to provide current income while secondarily striving for capital growth. This Fund offers investors an actively managed core U.S. fixed income fund that invests in a diversified portfolio of primarily high-quality bonds and other. Income stocks are equity financial securities that pay regular and predictable dividends. They are purchased to generate a steady stream of dividend flows.

Vanguard Wellesley Income Fund Investor Shares (VWINX) - Find objective, share price, performance, expense ratio, holding, and risk details. PIMCO Income Fund - USF Seeks to maximize current income; long-term capital appreciation is a secondary objective. Capital World Growth and Income Fund (Class A | Fund 33 | CWGIX) seeks to provide long-term growth of capital while providing current income. An income-oriented equity fund that has historically provided capital appreciation while cushioning market volatility. Income stocks are securities that make regular payments through dividends. These types of stocks tend to be less volatile and more stable compared to other. Income stock. Browse Terms By Number or Letter: Common stock with a high dividend yield and few profitable investment opportunities. To understand these differences and decide which fund is best suited for you, review the prospectuses and consult your investment professional. JEPI. JPMorgan. Find latest pricing, performance, portfolio and fund documents for Franklin Income Fund - FKIQX. PGIM Muni High Income Fund may appeal to investors seeking competitive tax-exempt yields by investing in a blend of higher and lower rated muni bonds. Find the latest Realty Income Corporation (O) stock quote, history, news and other vital information to help you with your stock trading and investing. Realty Income stock information is provided here for investors, including our updated open & closing share prices and annual, quarterly, and half-yearly. Share prices may rise or fall depending on the company's health and outlook, but these stocks have the potential to gain value while paying reliable dividends. Income Stock is a form of security which provides regular dividends to the investors. This dividend steadily grows over time to adjust for dividend to. The Fund has adopted a policy to pay common shareholders a stable monthly distribution, and may pay distributions consisting of amounts characterized for. Tax-Advantaged Dividend Income Fund · 1. Distribution Rate at NAV and Market Price is calculated by dividing the last distribution paid per share (annualized) by. Most stocks can be classified into one of three categories: growth, income or value. Those who understand the characteristics of each type of stock can use. Seeks to achieve attractive income with less risk by tactically managing a portfolio of equities, fixed income and non-traditional sources of income. The Fund seeks to achieve its investment objectives by investing primarily in a diversified portfolio of equity and fixed income securities of companies in the. Income stock. Browse Terms By Number or Letter: Common stock with a high dividend yield and few profitable investment opportunities.

What Are The Closing Costs On A 350 000 Home

.jpg)

Closing costs usually range from 2% to 5% of the value of your mortgage and are paid in addition to your down payment. State. -- Select State Down Payment + Closing Costs, $, Loan Amount, $, Monthly Payment However, home-buyers must pay an upfront mortgage insurance premium at closing. The best guess most estimates will give you is that closing costs are typically between 2% and 5% of the home value. Buyer closing costs in NYC are between % to 6% of the purchase price. Buyer closing costs are higher for condos vs. co-ops, and closing costs are the highest. Closing Costs: Closing costs can be negotiated between the buyer and seller. FHA Closing Cost Calculator. Use this calculator to quickly estimate the closing costs on your FHA home loan. Get Current FHA Loan Rates. For your convenience. Estimated closing costs for sellers are usually about 5% to 6% of the sale price in closing costs, while buyers typically pay between 2% and 5%. For estimated closing costs, the rule of thumb is 3%-6% of the home's purchase price. For a typical Orlando home purchased for $,, that means your closing. Closing costs often add up to about 2% to 5% of the purchase price of the home. That equates to between $5, and $12, on a $, mortgage and comes on. Closing costs usually range from 2% to 5% of the value of your mortgage and are paid in addition to your down payment. State. -- Select State Down Payment + Closing Costs, $, Loan Amount, $, Monthly Payment However, home-buyers must pay an upfront mortgage insurance premium at closing. The best guess most estimates will give you is that closing costs are typically between 2% and 5% of the home value. Buyer closing costs in NYC are between % to 6% of the purchase price. Buyer closing costs are higher for condos vs. co-ops, and closing costs are the highest. Closing Costs: Closing costs can be negotiated between the buyer and seller. FHA Closing Cost Calculator. Use this calculator to quickly estimate the closing costs on your FHA home loan. Get Current FHA Loan Rates. For your convenience. Estimated closing costs for sellers are usually about 5% to 6% of the sale price in closing costs, while buyers typically pay between 2% and 5%. For estimated closing costs, the rule of thumb is 3%-6% of the home's purchase price. For a typical Orlando home purchased for $,, that means your closing. Closing costs often add up to about 2% to 5% of the purchase price of the home. That equates to between $5, and $12, on a $, mortgage and comes on.

Use our free Florida mortgage closing costs calculator to quickly estimate your closing expenses on your home mortgage. Includes taxes, insurance, PMI. Real Estate Closing Cost Calculator. If you know when you are likely to purchase a home & the price of the property you can use this calculator to estimate. Closing Costs ; Appraisal Fee, $ – $2, ; Credit Report Fee, $45 -$+ ; Bank Attorney, $ – $ ; Lien Search, $ – $ ; UCC-1 Filing Fee, $ If you're still unsure what to do here, we don't blame you. Link. Home loan calculators. Mortgage calculator · Closing cost calculator · Refinance calculator. $23k in closing costs on a $k home is very high. That's over % of the purchase price which is well above average. You can try. If you buy a property in that range, expect to pay between $1, and $5, in closing costs after taxes. Data, Value. Average home sale price, $, Average Closing Costs by County ; Allendale, $2,, $49, ; Anderson, $3,, $, ; Bamberg, $2,, $75, ; Barnwell, $2,, $81, The third tab shows current Mountain View mortgage rates to help you estimate payments and find a local lender. A guide to better understanding closing costs is. $ $0. B. Services Borrower Did Not Shop For. This is a These closing costs are part of Houzeo's home buyer closing cost calculator for South Dakota. 70% 14% 4% 12% Principal & Interest Property Taxes Home Insurance Other Cost ; House Price, $, ; Loan Amount. Estimate how much you could pay in closing costs—or settlement charges—based on your estimated interest rate and loan terms of your Mortgage. The charges and fees associated with these service providers are usually covered by the buyer as part of the home's closing costs. cost up to a few thousand. Purchase price: Closing costs are often estimated to be between 2% and 5% of the final sale price of your house, according to Zillow. In other words, the more. Home inspection, $$; Appraisal, $$; Credit report $; Private mortgage insurance premium, Varies,% of loan amount (based on credit). Buyer closing costs are real estate transaction fees that are paid in addition to your down payment and mortgage amount - including taxes, title insurance. Our closing cost calculator estimates your total closing costs if you are buying a house. Closing costs are usually 2% - 5% of the loan amount. Closing costs usually range from 2% to 5% of the price of your mortgage loan amount. For example, if you buy a $, home with 10 percent down ($10,) and. The average closing costs range from to 5% of the total loan amount. In Georgia, the average closing cost amount is $1, for a $, mortgage. That is. On a $,, year mortgage with a 6% APR, you can expect a monthly payment of $2,, not including taxes and interest (these vary by location and. Your total estimated refinancing costs will be: $6, · Loan Info · Choose a term length · Taxes & Insurance · Origination Fees · Other Settlement Services.

Whats The Best Card To Build Credit

PREMIER Bankcard credit cards are for building credit. Start building credit by keeping your balance low and paying all your bills on time each month. Credit cards offer a useful and effective way to build credit, but you don't need one to build good credit. Other credit-building products and strategies are. Chase Freedom Rise℠ is the best credit card to build credit because it offers automatic credit line reviews, no annual fee and unlimited cash rewards. The Scotiabank®* Platinum American Express® Card has a % annual interest rate (many credit cards charge between 19% to %). This interest rate extends. Best cards to build credit · Capital One Platinum Credit Card: Best for establishing credit · Chase Freedom Unlimited: Best for future value · Discover it Secured. A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very convenient. One way to start a. Whether you're a student just starting to establish credit or you need to rebuild credit, we have credit cards that are designed to help build or rebuild your. Credit One Bank NASCAR American Express Credit Card for Rebuilding Credit · 1% (cash back) · % Variable · $75 First year. $99 thereafter, billed monthly at. Instead of opening another credit builder, why not look into secured cards that graduate and have rewards now? Discover and US Bank are good. PREMIER Bankcard credit cards are for building credit. Start building credit by keeping your balance low and paying all your bills on time each month. Credit cards offer a useful and effective way to build credit, but you don't need one to build good credit. Other credit-building products and strategies are. Chase Freedom Rise℠ is the best credit card to build credit because it offers automatic credit line reviews, no annual fee and unlimited cash rewards. The Scotiabank®* Platinum American Express® Card has a % annual interest rate (many credit cards charge between 19% to %). This interest rate extends. Best cards to build credit · Capital One Platinum Credit Card: Best for establishing credit · Chase Freedom Unlimited: Best for future value · Discover it Secured. A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very convenient. One way to start a. Whether you're a student just starting to establish credit or you need to rebuild credit, we have credit cards that are designed to help build or rebuild your. Credit One Bank NASCAR American Express Credit Card for Rebuilding Credit · 1% (cash back) · % Variable · $75 First year. $99 thereafter, billed monthly at. Instead of opening another credit builder, why not look into secured cards that graduate and have rewards now? Discover and US Bank are good.

The Discover it® Student Cash Back is our top choice for the best first credit card for several reasons: There's no annual fee, no credit history required and. With Discover, upgrade to an unsecured card after 6 consecutive on-time payments and maintaining good status on all your credit accounts Building a good credit history · Pay bills - hydro, phone, cable - on time - If you're the forgetful type, set up direct bill payments from your bank account. Build your way to a better credit rating The Home Trust Secured Visa card is designed for people with untraditional credit histories such as self-employed. Check out the best first credit cards for building credit in September , offering valuable welcome bonuses for those with limited credit. 8 best secured credit cards to help build or repair your credit. This acts as collateral for your credit card. This is a great option for those looking to build or rebuild their credit. By using your secured card. Hear from our editors: Best secured credit cards of August · Best for rewards: Discover it® Secured Credit Card · Best for a low deposit: Capital One. Unlike your Prepaid Card, UNITY Visa secured card can help you build your credit. Apply online in less than 5 minutes, and you could be approved today! No. If you're trying to build or improve your credit history but are unsure where to start, a secured credit card could be a good option for you. What are secured. The Discover it® Secured Card can help you build credit with responsible use2, like making your payments on time and in full each month. Payment history is. If you're simply new to the world of credit or are trying to expand your credit history, consider applying for a credit card for fair credit, like. PREMIER Bankcard® Mastercard® Credit Card · PREMIER Bankcard credit cards are for building credit. · Start building credit by keeping your balance low and paying. What is a credit builder card? A credit builder credit card is a type of credit card that's designed to allow you to improve your credit score, in the event. If approved for this card, you could earn % cash back on every purchase. In addition, cardmembers can receive discounts from select Chase partners on. Fortunately, there are good credit cards to build credit for people who don't already have a U.S. credit history. For example, Discover® and Capital One® offer. Hear from our editors: Best secured credit cards of August · Best for rewards: Discover it® Secured Credit Card · Best for a low deposit: Capital One. Build Payment History Your payments are reported to the credit bureaus added to your credit report. Payment history makes up 35% of your credit score. Secured. Best Credit Cards to Build Credit in August · Best in Student Credit Cards · Discover it® Student Chrome · BankAmericard® Secured Credit Card · Capital One. Why We Like It: The Discover it® Secured Credit Card is a good option for beginners with no credit because it is inexpensive to own, offers great rewards.

Can I Get A Debit Card At 12

/parts-of-a-debit-or-credit-card-front-and-back-315489-42e20e660e15471cac4b955a77e2e331.jpg)

Since teens must be 16 to get a checking account at many financial institutions, families who want a card for the younger set can opt for prepaid cards. Parents. So your child (aged 11+) can transfer money to other accounts and set up direct debits and standing orders. They also come with a debit card, or if you prefer. Chase First Banking is available for kids ages and designed with kids ages in mind. Does Chase First Banking allow direct deposit? 3 FC Cincinnati Debit Card holders will receive a $12 credit deposited to their linked First Financial Bank checking account within business days when. spending. Monitor balance from the Venmo app and get real-time spending alerts. You can adjust privacy settings, view transactions, or lock the debit card at. Can You Be 12 and Have a Debit Card? The age requirements for financial products like debit cards depend on the bank. Legally, U.S. financial institutions can. A parent can open a bank account for their 12 year old, jointly as a cosigner, and attach a debit card to it if they wish. The bank assumes no. Greenlight's debit card for kids empowers parents to teach trade-off decisions, money management, and the power of saving and investing – in one app. For teens age 13 - 16, look no further than the Clear Access Banking account. Great for middle and high school students and parents who want a joint account. Since teens must be 16 to get a checking account at many financial institutions, families who want a card for the younger set can opt for prepaid cards. Parents. So your child (aged 11+) can transfer money to other accounts and set up direct debits and standing orders. They also come with a debit card, or if you prefer. Chase First Banking is available for kids ages and designed with kids ages in mind. Does Chase First Banking allow direct deposit? 3 FC Cincinnati Debit Card holders will receive a $12 credit deposited to their linked First Financial Bank checking account within business days when. spending. Monitor balance from the Venmo app and get real-time spending alerts. You can adjust privacy settings, view transactions, or lock the debit card at. Can You Be 12 and Have a Debit Card? The age requirements for financial products like debit cards depend on the bank. Legally, U.S. financial institutions can. A parent can open a bank account for their 12 year old, jointly as a cosigner, and attach a debit card to it if they wish. The bank assumes no. Greenlight's debit card for kids empowers parents to teach trade-off decisions, money management, and the power of saving and investing – in one app. For teens age 13 - 16, look no further than the Clear Access Banking account. Great for middle and high school students and parents who want a joint account.

Open a Bank of America Advantage SafeBalance Banking® account and get a debit card to make quick, and secure transactions. Upon enrollment, we will round up. If you're questioning whether kids can even have debit cards, First National Bank and Trust's answer is absolutely! Our Basic Personal Checking Account is a. A debit card, however, normally won't be issued until the child turns 15 (Aeon, MUFG, Resona, Sony, others) or 16 (Rakuten, ). Below the age of 15, you. Deposits to your Way2Go Card® will begin approximately 12 calendar days after your card Can I get a statement of charges on my debit card? Yes, you can get a. Confirm age eligibility: Some age limits start around 8 or 10 years old, some debit cards for teens require at least age 13, and other cards have no minimum age. You can get a debit card for a child through banks like Capital One, Axos, or Alliant Credit Union and financial technology apps like Till, Greenlight, Current. Minors 12 and older can apply for a CEFCU Debit Mastercard if a parent or legal guardian is a joint member on the account. My Use Account. Saving for. Dean Brauer: “This is largely a decision by the parent about what is right for their family. Research shows kids can develop their attitudes and habits towards. Receiving your kid's debit card: Once you've signed up and funded your Parent Wallet, a debit card will be automatically ordered for your kid. It typically. Money moves that can make a difference., 1 minute. 10 resources · View all From using debit cards to monitoring account balances to avoiding fees. Children aged 12 and under may be limited to savings accounts with ATM cards. Teens are usually allowed to hold debit cards. They can use the cards to make. Parents and teens have their own mobile app logins for MONEY. Teens can manage their money, while parents have visibility and control. The Greenlight debit card is one of the most popular debit cards for kids, and it can help teach them how to spend money, save and invest. The card offers. When is the Right Time to Get Your Teenager a Debit Card of Their Own? · Has reliable income · Has a habit of regular savings deposits · Does not lose his or her. Joint Checking Account with a Debit Card: You can jointly open a checking account with a child under the age of 18, and give them a debit card that way. Student. There is no age restriction to owning a debit card. However, members younger than 18 must list a responsible adult as a joint member on the account to grant. You have complete control of the account, meaning you can disable your child's card or change its spending limit at any time. Debit cards are like credit. Having a child bank account or a pocket money app with a debit card can give them added freedom, while still allowing an adult to have an element of control. Greenlight's debit card for kids empowers parents to teach trade-off decisions, money management, and the power of saving and investing – in one app. In addition to giving teens practical experience with managing money, having access to a debit card can reduce the need to have cash on hand for purchases that.

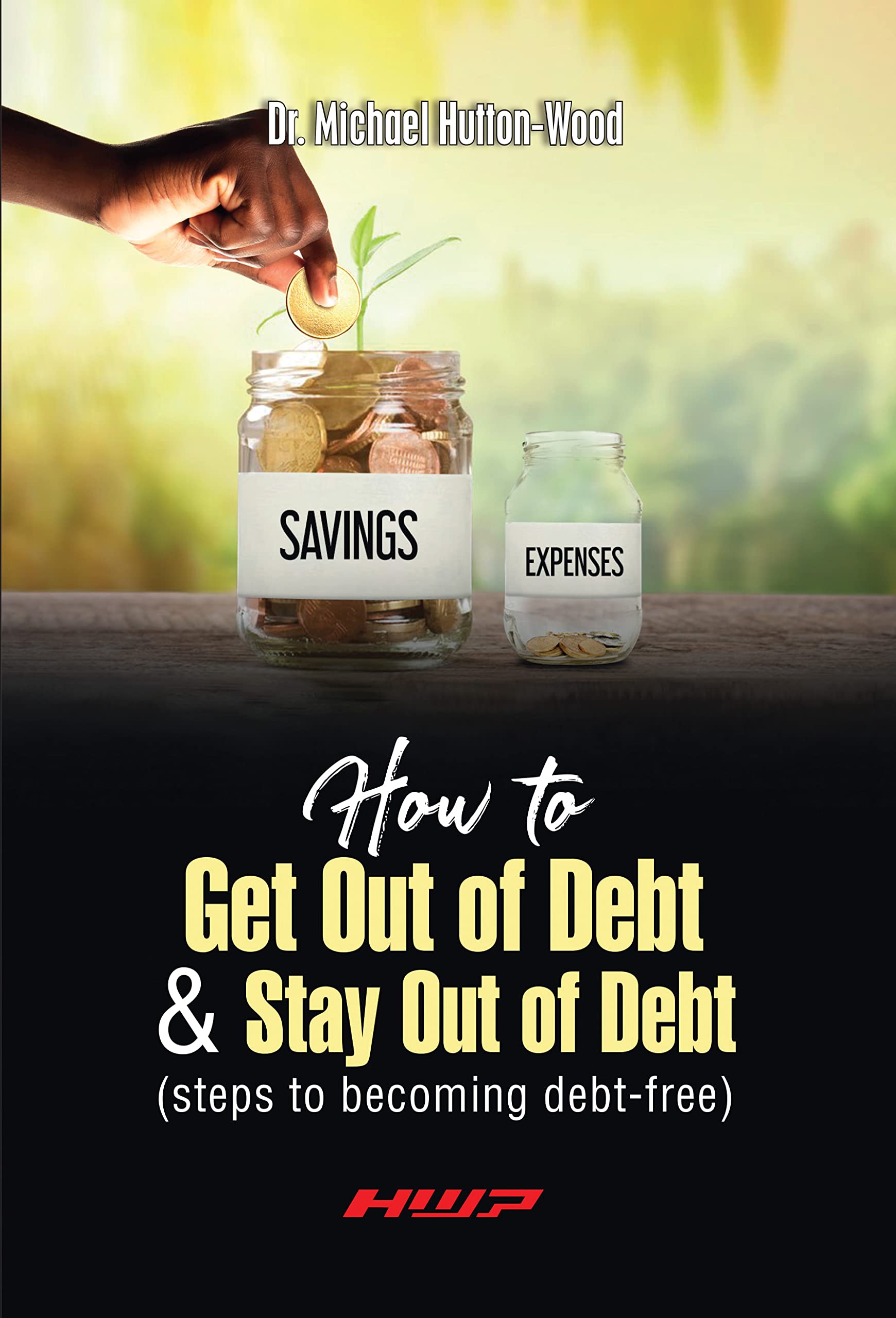

How To Get Out Of Debt Book

This book is not only a step-by-step process that will walk you through how to pay off your debt—it's a deeply personal journey centered around changing your. Based on the Proven Principles and Techniques of Debtors Anonymous · Publisher Description · More Books Like This · More Books by Jerrold Mundis · Customers Also. Reverend James Meeks offers this practical manual to help believers obtain freedom from debt so they can properly love and serve others in need. Maxed Out: Hard Times in the Age of Easy Credit by James Scurlock I like to think of this one as a personal finance thriller. James Scurlock travels across. How to Get Out of Debt, Stay Out of Debt, and Live Prosperously: Based on the Proven Principles and Techniques of Debtors Anonymous by Mundis. About the Book · I wrote Get the Hell Out of Debt after my own struggle to become consumer-debt-free. · This book is not only a step-by-step process that will. Take control of your finances with expert advice on prioritizing and consolidating debt. From credit cards to mortgages, this guide covers it all. Thousands of amazing humans have eradicated millions of dollars in debt because Erin Skye Kelly taught them how to get the hell out of it! Erin Skye Kelly wrote. This book will teach you what the top 1 percent know about money and the tools they use to grow, protect, and pass that wealth to their heirs tax free. This book is not only a step-by-step process that will walk you through how to pay off your debt—it's a deeply personal journey centered around changing your. Based on the Proven Principles and Techniques of Debtors Anonymous · Publisher Description · More Books Like This · More Books by Jerrold Mundis · Customers Also. Reverend James Meeks offers this practical manual to help believers obtain freedom from debt so they can properly love and serve others in need. Maxed Out: Hard Times in the Age of Easy Credit by James Scurlock I like to think of this one as a personal finance thriller. James Scurlock travels across. How to Get Out of Debt, Stay Out of Debt, and Live Prosperously: Based on the Proven Principles and Techniques of Debtors Anonymous by Mundis. About the Book · I wrote Get the Hell Out of Debt after my own struggle to become consumer-debt-free. · This book is not only a step-by-step process that will. Take control of your finances with expert advice on prioritizing and consolidating debt. From credit cards to mortgages, this guide covers it all. Thousands of amazing humans have eradicated millions of dollars in debt because Erin Skye Kelly taught them how to get the hell out of it! Erin Skye Kelly wrote. This book will teach you what the top 1 percent know about money and the tools they use to grow, protect, and pass that wealth to their heirs tax free.

How to Get Out of Debt ; ISBN ; ISBN ; Format: Paperback ; Copyright: ; Publisher: Createspace Independent Pub. Buy a cheap copy of How to Get Out of Debt, Stay Out of book by Jerrold Mundis. With up-to-the-minute information And an all-new preface by the. Debt-FREE Living HOW TO GET OPUT OF DEBT AND STAY OUT by Larry Burkett. Debt-Free Living has been providing poignant & biblical teaching on debt for over a. In the easy-to-read, accessible style of the Get Out of Debt! series, authors David and Marcia Rye explain how to. Based on the proven techniques of the national Debtors Anonymous program, here is the first complete, step-by-step guide to getting out of debt once and for. Buy everything you need and lead a rich and fulfilling life, while clearing all your debts and rebuilding your relationships, without using willpower or. Get the expanded and updated edition of one of Dave Ramsey's best money books—The Total Money Makeover—a simple seven-step plan to beat debt and build. Get out of debt and rebuild your credit. With the step-by-step guidance in this book, you can regain financial freedom. debt and build wealth In this book, you'll get the tools and the encouragement you need to. The GOOD Book: Get Out of Debt by Pam Young - ISBN - ISBN - Good Impressions, Inc. - - Softcover. About The Book · Assess debt problems · Use home equity to get rid of debt · Cut college expenses · Live within a budget · Understand bankruptcy law · Stay out. "Getting Out of Debt Joyfully" isn't for the reader looking for a quick fix to their debt situation. But it will prove to be 'real world' instructional guide. Ways to Get Out Of Debt and On the Road to Wealth is the ultimate handbook for anybody who wants to get out of debt and stay out of debt. This book will. Get Out of Debt Get your finances under control now. Feel the peace of knowing your checkbook is balanced and in the black. Relish the bliss of paying your. series, authors David and Marcia Rye explain how to: Assess debt problems Use home equity to get rid of debt Cut college expenses Live within a budget. Ready to get out of debt for good? Dig Out Of Debt of the Best Ideas from suntorin.ru Dig Out Of Debt is available as a series of 5 e-books. Get Out of Debt Get your finances under control now. Feel the peace of knowing your checkbook is balanced and in the black. Relish the bliss of paying your. About the Book · I wrote Get the Hell Out of Debt after my own struggle to become consumer-debt-free. · This book is not only a step-by-step process that will. How to Get Out of Debt, Stay Out of Debt, and Live Prosperously: Based on the Pr ; Quantity. 1 available ; Item Number. ; ISBN. ; Book. This book is a must read. Not only will it teach you how to heal your relationship with your money, but it will do it in a way that makes you belly laugh.

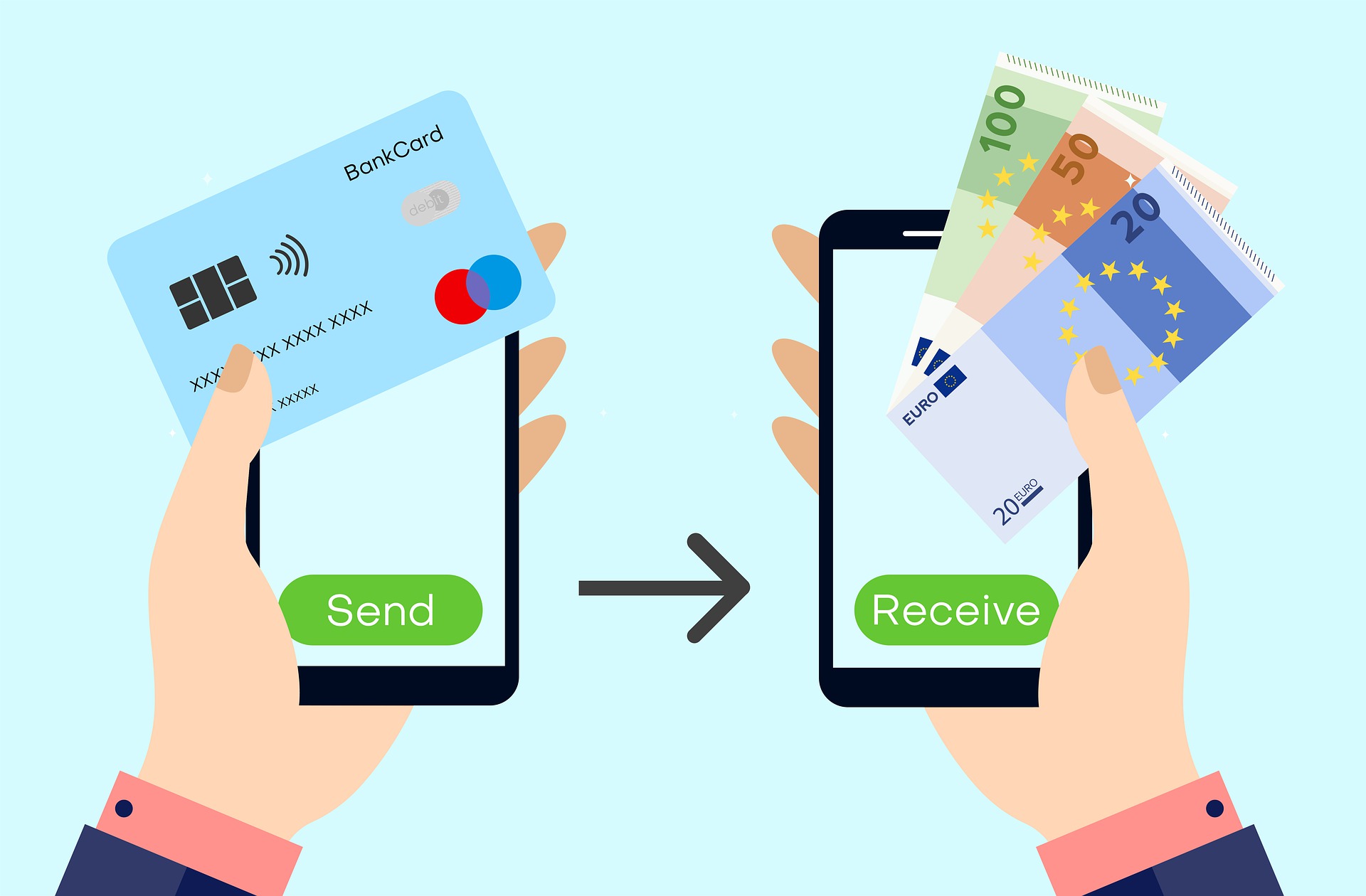

Applications To Transfer Money

Best apps to send money · Best for budding investors: CashApp · Best between friends: Venmo · Best for flexible payments: PayPal · Best for bank-to-bank. Remitly This app is among the highest-rated money transfer apps both in Google Play and the App Store. · MoneyGram. The MoneyGram app allows for almost instant. Trusted by millions worldwide, the Remitly app allows you to send fast and secure money transfers to banks and approximately ,+ cash pickup locations. A money transfer app usually costs about $37, to build. However, the total cost can be as low as $25, or as high as $50, A money transfer app with a. Choose a payment method that works for you, such as a debit or credit card. Sign up and start your online money transfer today. Get started now. Send mobile money transfers from the United States internationally with a few taps in the MoneyGram® Money Transfers app on iOS or Android mobile devices. Venmo is our number one choice for domestic transfers to friends and family, while Zelle is great for free domestic bank-to-bank transfers in particular. Cash. Send App enables you to transfer money instantly! Transfer cash to recipients in most countries for lightning-fast access to the funds. Receive and send money for free with Cash App. Pay anyone in using a phone number, email, or $cashtag. Send and receive stocks and bitcoin, too. Best apps to send money · Best for budding investors: CashApp · Best between friends: Venmo · Best for flexible payments: PayPal · Best for bank-to-bank. Remitly This app is among the highest-rated money transfer apps both in Google Play and the App Store. · MoneyGram. The MoneyGram app allows for almost instant. Trusted by millions worldwide, the Remitly app allows you to send fast and secure money transfers to banks and approximately ,+ cash pickup locations. A money transfer app usually costs about $37, to build. However, the total cost can be as low as $25, or as high as $50, A money transfer app with a. Choose a payment method that works for you, such as a debit or credit card. Sign up and start your online money transfer today. Get started now. Send mobile money transfers from the United States internationally with a few taps in the MoneyGram® Money Transfers app on iOS or Android mobile devices. Venmo is our number one choice for domestic transfers to friends and family, while Zelle is great for free domestic bank-to-bank transfers in particular. Cash. Send App enables you to transfer money instantly! Transfer cash to recipients in most countries for lightning-fast access to the funds. Receive and send money for free with Cash App. Pay anyone in using a phone number, email, or $cashtag. Send and receive stocks and bitcoin, too.

The apps of most major banks, for example, include Zelle®, a fast and safe way to send money to friends and family. If your bank doesn't use Zelle®, there are. Most money transfer apps are secure and have preventive measures attached to them to ensure your safety. The most convenient way to send money to loved ones abroad. TalkRemit is the trusted online money transfer service, with flexible payment options & instant. Save time at the counter by starting your money transfer on our app or online and paying in cash at a participating agent location. Western Union is the best international money transfer app to instantly send or receive money, track your transfers, and set up payments 24/7. With Zelle®, the money goes directly into your bank account. And when money goes into your bank account directly, you can live delightfully. Zelle® is already. Best International Money Transfer Apps Compared & Reviewed · Compare The Best UK Money Transfer Apps · Our picks of the best money transfer apps · #1 Wise: A. From the mobile app: · Use your fingerprint to securely log in. · Select Pay & Transfer then Transfer between my accounts. · Select the account you want to. From the mobile app: · Use your fingerprint to securely log in. · Select Pay & Transfer then Transfer between my accounts. · Select the account you want to. Send App enables you to transfer money instantly! Transfer cash to recipients in most countries for lightning-fast access to the funds. Xoom is the fast, safe, and reliable way to send money to friends and family abroad. We have you covered with: 24/7 transaction protection and fraud monitoring. The most international money transfer app. Send money, receive payments from abroad, check exchange rates, pay bills or send money back home to your loved ones. Quick, reliable and trusted app to send and receive money anywhere in the world. Send money to Nigeria, Ghana, Ethiopia, Cameroon. see more countries. Here's our pick of the best money transfer apps that'll let you transfer money from a credit card to a bank, or directly from bank account to bank account, or. Send mobile money transfers from the United States internationally with a few taps in the MoneyGram® Money Transfers app on iOS or Android mobile devices. Send money abroad to your loved ones. Fast and secure international money transfers with the Sendwave app. Trusted by one million users around the world. Quick, reliable and trusted app to send and receive money anywhere in the world. Send money to Nigeria, Ghana, Ethiopia, Cameroon. see more countries. Learn more about measures you can take to protect your money and the most common money transfer scams to watch out for. Transfer money online securely and easily with Xoom and save on money transfer fees. Wire money to a bank account in minutes or pick up cash at thousands of. Send money abroad to your loved ones. Fast and secure international money transfers with the Sendwave app. Trusted by one million users around the world.